Posts

Common Myths About Credit Scores

How is a credit score calculated? It is a complex answer and, as such, common myths persist. Today, we will help you get a better understanding of your credit score and how to make the grade by busting the most common credit score myths!

MYTH #1: TOO MANY CREDIT CARDS WILL HURT MY CREDIT SCORE

The reality is that cancelling healthy, active cards or accounts hurts more than having too many. When you cancel a card, all your payment history is lost as well as the type of credit granted. While you may think having a couple credit cards is extreme, the average Canadian has TEN credit sources. What many Canadians don’t realize is that lenders want to see a history of credit; they want to see payments made on time. In addition, lenders also want to see balances maintained at no more than 70% of your credit limit in use. So, if you have a $10,000 credit card, you don’t want to owe more than $7,000 on it at a time.

MYTH #2: AVOID USING CREDIT CARDS IF YOU WANT TO BUILD CREDIT

It is easy to think that different forms of credit matter more than others, but that is simply not the case. In fact, all lenders want to see is a history of credit and payments made on time. This is what builds your credit score and, eventually, give you the ability to qualify for financing. A history of on-time payments and manageable balances shows the lender that you are a promising investment and not likely to default.

MYTH #3: PAYING MONTHLY UTILITIES BUILDS CREDIT

Unfortunately, paying utilities does not build credit. In fact, these providers only check your credit score to determine creditworthiness. These don’t report your payment history to the bureau, unless you are late to pay. The other organizations that only report on default are municipalities and insurance providers, so make ensure these are current. Be sure to pay any traffic tickets and bylaw infractions too!

MYTH #4: I CAN’T DO ANYTHING ONCE A PAYMENT IS LATE

Don’t be discouraged. Lenders understand that you are only human and, in many cases, they will work with you if there is a late payment. If they are notified within a timely manner, a late payment can be easily reversed. Just be careful not to make a habit of it.

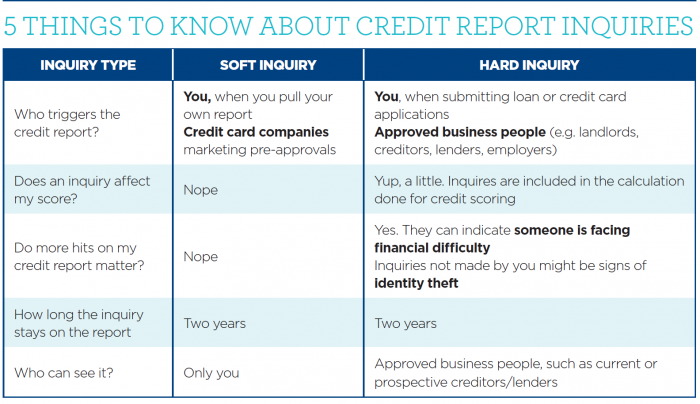

MYTH #5: CHECKING MY CREDIT SCORE WILL DECREASE IT

No exactly. There are two types of credit inquiries: soft and hard. A soft inquiry occurs when you pull your own credit report. Credit card companies also pull this type of inquiry when marketing pre-approval offers. Soft inquiries do not affect your credit score.

A hard inquiry, on the other hand, is triggered by the applicant when submitting a loan or credit card applications. As a result, hard inquiries will affect your credit score slightly as they are included in the calculation done. Recording the number of inquiries a consumer has on the credit report allows lenders to see how often consumers applied for new credit. This can be a precursor to someone facing credit difficulty. Too many inquiries may mean that a consumer is deeply in debt and is now searching for loans or new credit cards to bail themselves out. Another reason for recording inquiries is for preventing identity theft. Hard inquiries not made by you could possibly be from a fraudster trying to open accounts in your name. Therefore, only individuals with a specific business purpose can check your score. The inquiry only appears on the credit report that was checked.

In addition, hard inquiries remain on all credit reports for two years, then these are removed. Soft inquiries appear only on the report that you request from the credit bureaus and will not be visible to potential creditors.

Credit score plays a vital role when it comes to potential financing for car loans, mortgages, or even personal loans. It is important to maintain good credit habits now for a higher credit score today, and better chance of financial approval in the future.

Key Steps Home Sweet Home

Key Steps to Home Sweet Home. There is nothing more exciting than moving into a new home. Whether a new building or re-sale property, there are a few things you can do as soon as you take possession in order to make it your own. Invest a weekend or two into warming up a featureless space or refreshing someone else’s old homestead.

Key Steps Home Sweet Home you can do to own your new space:

- Change The Locks :Secure your home by changing the locks as soon as you take possession. Even DIY beginners can change a deadbolt lock. A replacement deadbolt set can be installed in place of the current lock with just a screwdriver— no drilling required. Another option is to rekey the lock. Purchase a rekeying set from the same manufacturer as the existing door lock, and reset it for a new key

- Consider a Professional Deep Cleaning: Hiring a professional cleaner to deep-clean and detail your home before you move your possessions in can make your new home feel that much more YOU! It will be easier without any furniture to work around, allowing them to access to every nook and cranny. Yes, you’ll have to clean again after moving day, but the heavy lifting will have already been done!

- Clean Out Your Pipes: Years of dust, pet dander and detritus collect in the hidden workings of any home. One of the most effective ways to refresh a new home is to get right into the guts of it! Have your ducts, furnace and air conditioning unit professionally cleaned and be sure to change the filters as required to maintain that clean, fresh air.

- Apply a Coat of Paint: Painting provides the most bang for your home-improvement buck! Whether the walls of your home are dingy or you’re simply not feeling the magic of beige, it only takes a few hours to repaint your space with a colour that makes you feel at home.

- Freshen Up Your Floors: Much like worn-out walls, old floors can really put a damper on that new-home buzz. If your hardwood has seen better days, consider hiring professionals to re-do it or tackle the project yourself. For carpet, a deep steam clean can do wonders! For laminate, you can get that extra shine with a special laminate floor cleaner. Although if any of your floor coverings are lifting or have holes in them, time to replace it. You can further personalize your new space by adding floor runners or area rugs!

- Neutralize Odors: Any re-sale home can benefit from a deep-clean refresh to eliminate any lingering odors from previous tenants. While some of the above steps will dramatically reduce any lingering smells, stubborn aromas require spot treatments such as:

- Putting dishes of activated charcoal (also known as activated carbon) in a musty, damp basement. These can be found at aquarium stores.

- Running a dehumidifier during the spring and summer.

- Placing a sock filled with dry coffee grounds or baking soda in closets, refrigerators or freezers to absorb stale odors.

- Pouring white vinegar down a stinky drain.

- Enjoy the View! Dirty windows and screens can make rooms feel dark and dingy. A thorough cleaning will have your windows shining, and your indoors will feel brighter and fresher too. If your home came with the previous owner’s window coverings, be sure to clean or launder them; it’ll remove allergens as well as reduce any lingering odours. Or consider replacements with colors and patterns more suited to your style!

- Lighten Up! A well-lit home is immediately warmer and more inviting than its darker counterparts. If your rooms feel dim, replace the existing bulbs with bright, energy-saving LED or CFL bulbs for more light and cost-savings! Dated lighting fixtures can also foil your redecorating efforts, so consider replacing them with something more your style.

- Time for a Switch: Replacing your switch plates only requires a screwdriver but you would be surprised how much swapping out old lighting switch plates can refresh your space. With a little DIY expertise, screwdrivers, pliers and a voltage tester, you can install energy saving dimmer switches instead.

- Display Your Art: Once you have deep-cleaned your new home and organized it to your heart’s content, it is time to dress up your walls with your favourite artwork and family photos! Get your kids’ kindergarten masterpieces onto the fridge and deck out your mantel with family photos.

Moving into a new home is one of the best times to make your space perfect for you! With a clean slate and empty floor space, now is the time to include all the things that make your house a home – to you! Start your application TODAY

How the CHIP Reverse Mortgage Can Help You Support Your Adult Children

A CHIP Reverse Mortgage is a great answer for seniors with Canada’s recent housing market boom. According to the Canadian Real Estate Association (CREA), between April 2020 and April 2021, the average house price rose by a 41.9%. The average purchase price rising to $696,000 and data from previous years is similarly impressive.

This is, of course, great news for homeowners, but perhaps not such great news for those trying to get in on the property ladder. This has led to a boom in older Canadians helping their adult children with the funds or a down payment. According to a recent Bank survey, 31% of Canadians would help their adult child pay for a new home.

If this is you, it’s important to ask yourself how you will access the funds to help your child. You too can do the same while maintaining your own financial security. Check out the CHIP Reverse Mortgage Calculator to find out how you can access home equity

Withdrawing from Investments

Some people turn to savings and investments when they want to access a large sum of money. However, this may not always be the best idea. Cashing in investments has the potential to trigger taxes and OAS and CPP clawback. This could also as push up your marginal tax rate. Because it can also damage your overall portfolio, this may also have a negative effect on your future retirement income. Therefore, with more and more Canadians at risk of outliving their retirement savings this is very important to bear in mind.

Using the Equity in Your Home

In order to avoid the downsides of withdrawing from investments, you can use your home’s equity to help your adult children, that way they also benefit from Canada’s red-hot housing market and the equity it’s enabled you to build up.

HELOC

One way of accessing the cash in your home is through a home equity line of credit (HELOC). This revolving line of credit secured against your home that allows you to borrow up to 65% Loan to value. A HELOC can be a good way of accessing cash. With more 55+ borrowers having their applications denied simply because they lack a regular income due to being retired. Another drawback to the HELOC is the fact that the debt must be serviced monthly, which can eat into your monthly income.

The CHIP Reverse Mortgage

Another way of accessing the cash in your home is with the CHIP Reverse Mortgage. The CHIP Reverse Mortgage allows you to access up to 55% of your home’s value in tax-free cash. This can be used to gift an early inheritance to your adult children. Therefore helping them get into the property market and help the entire family.

The money you receive won’t damage your investment portfolio and won’t trigger taxes or OAS/CPP clawback. What’s more, since you only pay back what you owe once you leave your home, there are no monthly repayments adversely affecting your retirement income.

The CHIP Reverse Mortgage is a product that’s designed specifically for Canadian’s 55+ with an approval process to fit. This means we don’t discriminate against retirees or those without a regular income, all you have to do is own your home.

If you’d like to find out more about how the CHIP Reverse Mortgage can help you support your adult children, contact us at Prime Mortgage Works today!

Getting the Down Payment Down

A down payment is one of the most essential aspects of every mortgage application and new home purchase. In Canada, home purchases require a minimum cash payment from your own funds that is put towards the purchase. This is your down payment and is considered your stake in the deal.

Many home buyers understand that a certain amount of money down will be required on a home. However, most don’t realize the ins-and-outs of down payments, such as where the funds are allowed to come from and ensuring a proper paper trail.

Here are a few things to keep in mind while preparing your down payment and working towards your perfect home!

SOURCES OF DOWN PAYMENT

Most home buyers are aware that they will require a certain amount of money for a down payment. What many do not realize, is that lenders are required to verify the source of the funds. This allows them to ensure that they are coming from an acceptable source. Sources that further contribute to indebtedness are less-likely to be considered (such as line of credit or credit card). Instead, the best and most traditional options for your down payment are:

SAVINGS ACCOUNT

The first and most traditional method is your savings account, where you have been pinching your hard-earned pennies to save up for this day!

If you are utilizing your personal savings for a down payment, note that lenders will require three months of full bank statements. This includes name, account number, transactions and balance history. For any large deposits made in that time (sale of a car, work bonus, etc.), explanations and supporting documents will be required.

GIFT FROM FAMILY MEMBER

If you are fortunate enough to receive help from the Bank of Mom and Dad for your down payment, there are certain requirements:

- A signed gift letter from the immediate family member contributing the fund

- Proof of the transfer into your bank account. This can be a bank statement documenting the money being moved from the donor’s account and into yours. The statements must include names, account numbers and the full transaction history during the time period in question.

- Important note: If money is being received from immediate family overseas, most lenders will require copies of the wire transfer. In addition, they may ask for account history.

RRSP WITHDRAWAL

Another option for down payment is the use of Registered Retirement Savings Plan (RRSP), but only if you are a first-time buyer. This is part of the Home Buyers’ Plan (HBP), which allows first-time buyers to borrow up to $35,000 from their RRSP’s (tax-free!) -as long as the money is repaid within 15 years. Please note: The minimum repayment is 15 equal instalments paid once per year.

HOW MUCH DOWN?

When it comes to putting money down on your new home, you need to consider the minimum down payment required as well as additional fees.

The minimum amount required in Canada is 5% for the first $500,000, with 10% down on any amount beyond that threshold. For example, on a $600,000 house you would need to put $35,000 down at minimum. ($25,000 on the first $500,000 and $10,000 for the additional $100,000 purchase price).

If your down payment is less than 20% of the price of your home, we may be required to obtain mortgage loan insurance. These premiums range from 0.6% to 4.50% of the total amount of your mortgage. Using the example above, this would mean $3,600 to $27,000 in mortgage insurance premiums.

If you are able to put 20% down on your new home (which is the recommended amount), you would be looking at an investment of $120,000 down with no mortgage insurance premiums required.

ADDITIONAL COSTS AND FEES

One component of the purchase process that homeowners often forget about, are the closing costs. These are typically 1.5% up to 4% of the purchase price. In order to get financing, you are required to show that you have ample closing costs, which include legal fees.

When you have collected down payment funds, it’s ideal those funds remain in your account once confirmed. They should only leave your account when they are provided to your lawyer to complete the purchase. Given lenders will often request updated statements closer to the closing of the sale, to ensure nothing has changed. If money has been moved around, they may need to be confirmed and could affect approval.

The last thing that anyone wants when purchasing a property is added stress or for something to go wrong late in the process. Consider contacting a us at Prime Mortgage Works today to help guide you through the process! Make sure you are upfront about your down payment amount, and where it is coming from. This will help us determine its’ suitability, and allow us to find the best lender and product for you!

Outside The Box

For most Canadians, a home looks like a few different things. It is either a single-family dwelling, a townhome, condominium or a high-rise. But Daniel Croft, Vice President of Giant Container Services, is looking to change that with outside the box thinking.

In the quest to find less expensive housing, we have seen many new ideas crop up in the last decade. From container homes to tiny homes and even the centuries-old design of a yurt. Canadians and Canadian manufacturers are looking at the home in an entirely different way.

CONTAINER HOMES

Giant Container Services is a Toronto company that’s been converting shipping containers into homes for over 10 years. With roots in the trucking industry, it was in the early 2000’s when Croft’s grandfather started noticing these big containers being used for storage. This was the lightbulb that resulted in a new division being born – turning the containers into homes.

Croft started with 100 containers and has since noted business has been booming! During a conversation with Croft, he noted “huge interest in container homes” elaborating on some of the company’s projects, which included condominiums built out of hundreds of containers!

While he noted that many of his current clients are using the containers as a vacation property home, the demand continues to grow. Currently, Giant Containers offers four models ranging from a 320 square foot 1-bedroom / 1-bathroom build to a 960 square foot 2-bedroom / 2-bathroom build; all for just $85 a square foot! Despite the containers basically being a prefabricated steel structure, Croft says they’re built like a house and include electrical and plumbing; the same as you would find with a traditional build. His company also works to guide owners through the process of assembling the containers.

When asked about what type of people purchase these homes, Croft notes that his customers are millennials to couples in their 40’s. According to him, his clients and target demographic “knows they want to be in a container house. They like the look and feel of it and the sustainability aspect”. He admits that this is something he really feels that this is the future of building.

MICRO HOMES

As we are more focused on affordability, it is easy to see why small houses could be the start of a new eco-friendly future!

Located in British Columbia, a company known as Nomad Micro Homes also experienced a boom for its product. The company offers two styles of micro homes – their NOMAD Cube and NOMAD Micro. The Micro runs $25,500 USD for the studio version ($27,800 USD for the guest suite version) while the Cube will set you back $38,800 USD.

The founder and CEO of Nomad Homes, Ian Kent, describes the product as a “do it yourself” kit home. Similar to something you’d buy in Ikea that can be put together very quickly. While they may be simple, he notes people can live in them as a primary residence. It is also important to note that Nomad’s designs aren’t on wheels like some versions of tiny homes.

According to Kent, the company sells roughly 30 homes a year but has the ability to increase production scale to thousands of units if needed. Kent sees the tiny home as one answer to a rental supply crisis gripping B.C.’s Lower Mainland as it is an “extremely low-impact backyard dwelling it is small and private.

WHAT ABOUT A YURT?

If the container or micro home isn’t your thing, there’s a centuries-old way of living to put you more in touch with nature. The yurt design is essentially that of a circular tent. Patrick Ladisa, the President of Yurta, a manufacturer in Toronto, says he’s always been interested in minimalist architecture. Back in 2004, his company built its first yurt, which was designed to be a relief or cost-effective living shelter.

The company makes two sizes of yurts; a 13’ diameter (133’ sq) and a 17’ diameter (226’ sq). They also have additional options such as windows, a solid door and a chimney outlet. What you won’t likely see is much indoor plumbing. The attraction to the yurt compared to other alternative homes is a desire to be close to nature and outdoors.

As with any good business idea, Yurta has since evolved making a splash in the recreational market. Ladisa now sees people using the structures as a guest cottage, or as a cabin in the woods.

financing on an alternative home

When purchasing a prefabricated home, there are a few things to keep in mind with regards to financing.

It is only possible to get a mortgage on the property if it has been de-registered and permanently affixed to land. Otherwise, it’s considered a chattel loan (similar to an auto loan).

The age of the prefabricated home will determine the maximum amortization on the loan. You are only able to amortize a property the expected remaining economic life of the home, less five years.

A minimum down payment of 20 percent is still required for the purchase of the prefabricated home including the property. If the lot is already owned, then financing will depend on how much existing equity is in the land.

While challenging, it is important to remember that lenders are always changing their requirements and adding to their portfolios. This means they are updating which home types and properties they provide financing for. To make sure you understand all your options, it is best to talk with a mortgage broker for expert advice on whether or not alternative home financing is available to you – and what your other options might be!

Affording a 2nd Property

More and more Canadians are choosing to buy a second property in retirement. Some want to reap the rewards of a lifetime of saving and treat themselves to a vacation home. Others, on the other hand, view their second property as an investment, intending to rent it out and use the income in affording a 2nd property

Whatever your reasons for wanting to buy a second property, there are various ways you might choose to pay for it – let’s have a look at what those are.

PAYING THE DOWN PAYMENT – Affording a 2nd Property

Just like your first property, you’ll need a down payment for your second property. This can be as little as 5% but ideally should be higher – try aiming for 20%.

CASHING IN INVESTMENTS

One way that you may choose to make the down payment is by cashing in on investments. When considering this, however, caution should be exercised. Cashing in on investments in a taxable account can trigger taxes and OAS clawback, as well as potentially pushing you into a higher tax bracket. Taking large sums from your investments will also reduce the size of your portfolio, which can have a knock-on affect on your retirement income. Outliving savings is something all retirees should be conscious of, so think carefully before making large withdrawals that may deplete your pension pot too quickly.

TAKING OUT A HELOC

A Home Equity Line of Credit (HELOC) is a revolving line of credit secured against your primary residence which allows you to access up to 65% of your home’s value. Taking out a HELOC to pay for the down payment can be a good option to avoid cashing in on investments, but they’re not without their limitations. It’s recently become more difficult to get approval for a HELOC, and many retired Canadians without a fixed monthly income have seen their applications denied. If you manage to get approved for the loan, be aware that you need to service it each month, which will have an affect on your monthly cashflow.

USING THE CHIP REVERSE MORTGAGE

Another way to afford the down payment on your second property is with the CHIP Reverse Mortgage. The CHIP Reverse Mortgage allows you to access up to 55% of your home’s value in tax-free cash, meaning it won’t trigger taxes or OAS clawback, or push you into a higher tax bracket. Unlike a HELOC, with a reverse mortgage you don’t repay what you owe until you move out of your home or pass away, so there are no monthly repayments eating into your cashflow. What’s more, depending on how much equity you have built up in your home and how much your home is worth, you may be able to pay off a significant amount of your second property – perhaps even paying for it outright!

PAYING OFF THE MORTGAGE

Unless you were able to pay for your second property outright, chances are you’ll have a monthly mortgage to pay in affording a 2nd property

If your second home is an investment property, you likely intend to rent it out. In this case, the rent you charge should be enough to cover your mortgage payments (and hopefully a little extra for you each month).

On the other hand, if your second property is a vacation home, you’ll need to factor mortgage repayments into your monthly budget. One way to get the best of both worlds is by renting your vacation property out for short-term holiday lets. This will help you cover some, if not all, of the mortgage payments, while also giving you the flexibility to enjoy your vacation home whenever you want. Want to know more about how the CHIP Reverse Mortgage could help you afford a second property? Contact us to learn more!

Mortgage Broker vs Specialist

Mortgage broker vs specialist: what’s the difference?

To most consumers outside of the mortgage space, the terms “mortgage broker”vs “specialist” would seem interchangeable – but they aren’t. As a potential homeowner, the differences are more important than you might think.

First and foremost, it is important to understand the definition of these groups before looking at the major differences. Mortgage brokers belong to an independent firm. This allows them unique access to rates and offers from various lenders’ (banks, credit unions, private lenders and alternative options). Conversely, a mortgage specialist is employed by a single lender and works to sell that particular institution’s products.

BENEFITS OF WORKING WITH A MORTGAGE BROKER:

1. MORTGAGE BROKERS WORK FOR YOU!

Unlike a mortgage specialist, who is paid by the bank to sell their products, a broker works for YOU! A broker works as a link between you and the lender; they filter through the offerings to find you the best rate and product. The best part? A mortgage broker’s services are FREE! Brokers are paid by the lender of choice once the ideal mortgage product has been found. This means you get to utilize their expert advice and lender access at no cost!

2. MORTGAGE BROKERS CARE FOR THEIR CLIENTS

Similarly to the above, Mortgage Brokers care for their clients. Not only because they work for YOU but also because most brokers are self-employed and rely on referrals. As a majority of their business is done through word-of-mouth, this results in the best experience for clients.

3. MORTGAGE BROKERS ARE LICENSED PROFESSIONALS!

It might surprise you to know that mortgage and bank specialists are not required to have any formal training. While some lenders do provide in-house training, this varies from the provincially regulated course that mortgage brokers are required to pass. Mortgage brokers also continue to maintain their education through license renewals and educational courses. As a result, a mortgage broker provides expert advice you can trust! A distinct advantage for a Mortgage Broker vs Specialist.

4. MORTGAGE BROKERS HAVE GREATER ACCESS TO RATES

A mortgage broker is employed by an independent firm and has access to 90+ lenders, while a mortgage specialist can only access their particular lenders’ products. This can mean a big difference in rates and mortgage terms for homeowners! If you are looking at getting a mortgage with your bank (say Bank X), then your mortgage specialist can tell you exactly what Bank X offers. But, by seeking the advice of a mortgage broker, they can tell you what Bank X offers… as well as your options with Bank Y, Bank Z, Bank A, etc. When you are looking for the best mortgage product to fit your unique needs, more options to choose from just makes sense! Advantage: Mortgage Broker vs Specialist.

5. MORTGAGE BROKERS FOCUS ON MORTGAGES

When it comes to mortgage brokers, all they do is mortgages; they live and breath home ownership! Mortgage specialists and bank staff are often trained with a focus on cross-selling. While you may have booked an appointment to discuss a mortgage, many times they will focus on other bank products. This might include offering credit cards, insurance, RRSP, lines of credit, etc. This can sometimes be helpful, but many potential homeowners may find it overwhelming or pushy; especially when they are specifically looking for a single product – a mortgage.

6. MORTGAGE BROKERS OFFER FLEXIBLE HOURS

Most banks don’t offer great business hours, which can make it hard to book an appointment with a specialist. As many mortgage brokers are self-employed, they are motivated to assist clients. This means they are often available for appointments outside of business hours such as evenings or weekends. This can be especially comforting to individuals who are new to the mortgage process and may have questions or concerns that they would prefer to have answered right away.

Get started today!

Get a quote now

Prime Mortgage Works

399 Tyee Road.

Victoria, BC V9A 0A8

Ph: 250-708-2063

Fx: 1 866-845-8513

info@primemortgageworks.com