Common Myths About Credit Scores

How is a credit score calculated? It is a complex answer and, as such, common myths persist. Today, we will help you get a better understanding of your credit score and how to make the grade by busting the most common credit score myths!

MYTH #1: TOO MANY CREDIT CARDS WILL HURT MY CREDIT SCORE

The reality is that cancelling healthy, active cards or accounts hurts more than having too many. When you cancel a card, all your payment history is lost as well as the type of credit granted. While you may think having a couple credit cards is extreme, the average Canadian has TEN credit sources. What many Canadians don’t realize is that lenders want to see a history of credit; they want to see payments made on time. In addition, lenders also want to see balances maintained at no more than 70% of your credit limit in use. So, if you have a $10,000 credit card, you don’t want to owe more than $7,000 on it at a time.

MYTH #2: AVOID USING CREDIT CARDS IF YOU WANT TO BUILD CREDIT

It is easy to think that different forms of credit matter more than others, but that is simply not the case. In fact, all lenders want to see is a history of credit and payments made on time. This is what builds your credit score and, eventually, give you the ability to qualify for financing. A history of on-time payments and manageable balances shows the lender that you are a promising investment and not likely to default.

MYTH #3: PAYING MONTHLY UTILITIES BUILDS CREDIT

Unfortunately, paying utilities does not build credit. In fact, these providers only check your credit score to determine creditworthiness. These don’t report your payment history to the bureau, unless you are late to pay. The other organizations that only report on default are municipalities and insurance providers, so make ensure these are current. Be sure to pay any traffic tickets and bylaw infractions too!

MYTH #4: I CAN’T DO ANYTHING ONCE A PAYMENT IS LATE

Don’t be discouraged. Lenders understand that you are only human and, in many cases, they will work with you if there is a late payment. If they are notified within a timely manner, a late payment can be easily reversed. Just be careful not to make a habit of it.

MYTH #5: CHECKING MY CREDIT SCORE WILL DECREASE IT

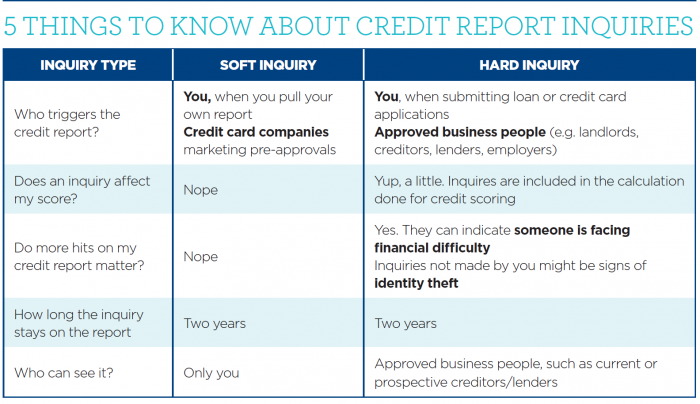

No exactly. There are two types of credit inquiries: soft and hard. A soft inquiry occurs when you pull your own credit report. Credit card companies also pull this type of inquiry when marketing pre-approval offers. Soft inquiries do not affect your credit score.

A hard inquiry, on the other hand, is triggered by the applicant when submitting a loan or credit card applications. As a result, hard inquiries will affect your credit score slightly as they are included in the calculation done. Recording the number of inquiries a consumer has on the credit report allows lenders to see how often consumers applied for new credit. This can be a precursor to someone facing credit difficulty. Too many inquiries may mean that a consumer is deeply in debt and is now searching for loans or new credit cards to bail themselves out. Another reason for recording inquiries is for preventing identity theft. Hard inquiries not made by you could possibly be from a fraudster trying to open accounts in your name. Therefore, only individuals with a specific business purpose can check your score. The inquiry only appears on the credit report that was checked.

In addition, hard inquiries remain on all credit reports for two years, then these are removed. Soft inquiries appear only on the report that you request from the credit bureaus and will not be visible to potential creditors.

Credit score plays a vital role when it comes to potential financing for car loans, mortgages, or even personal loans. It is important to maintain good credit habits now for a higher credit score today, and better chance of financial approval in the future.